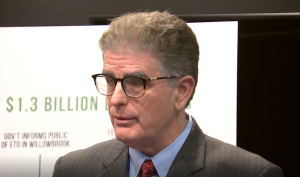

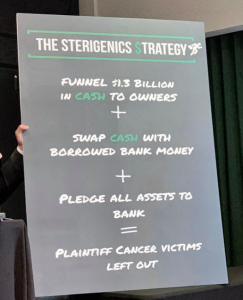

Yesterday, lawyers for the plaintiffs in the cases against Sterigenics held a press conference to expose what we have recently learned about the apparent attempts of Sterigenics and its corporate owners to make it more difficult for our clients who prove their cases to receive just compensation. As we detail in our newest court filing (and as summarized below), in the two years since the federal government in 2016 concluded that ethylene oxide is 30 times more potent of a carcinogen than previously believed, Sterigenics and its owners have taken $1.3 billion in cash out of the company, put it in their own pockets, and replaced it with money borrowed from banks. The effect of this is to put company cash and other assets out of reach of plaintiffs who prove that Sterigenics caused their cancers.

Rest assured: we will expose this behavior, get to the bottom of it, and hold Sterigenics accountable in court for anything they have done here that is unlawful. We will bring this behavior before the Judge and jury, and demand justice—which includes just compensation for our clients who prove their cases.

This past Friday, we filed an amended complaint adding new allegations to our lawsuits. The new allegations are as follows:

In December 2016, when the US EPA altered EtO’s cancer weight of evidence descriptor from “probably carcinogenic to humans” to “carcinogenic to humans” and changed its adult based inhalation unit risk to 0.0001 μg/m³ from 0.003 μg/m³ (a thirty-fold increase), GTCR recognized that its investment in Sterigenics had become substantially riskier and drastically increased its efforts to recover its money.

Sterigenics U.S., Sotera, and GTCR each played indispensable roles in a carefully-orchestrated funneling of nearly $1.3 billion to shareholders over 27 months beginning in 2016, with the intention of ensuring that these funds will not be available to compensate Plaintiffs when they secure judgments against them in this Court. By these transfers, Sterigenics U.S. and Sotera effectively admit, but hope to avoid accountability for, their culpability in exposing Willowbrook area residents (including Plaintiffs) to the extraordinarily dangerous EtO, which seriously damaged the health of many, and even claimed the lives of some.

Specifically, during those 27 months, Sterigenics U.S. and Sotera executives were learning:

Yet, throughout these months, Sterigenics U.S. and Sotera executives were working with their corporate parents to make sure that virtually all available cash and other assets would be funneled away from these unsecured-creditor-Plaintiffs — and instead to their venture-capitalist investors and their banks in the form of massive distributions, pledged assets, and hundreds of millions in interest payments on borrowings undertaken to fund these payments. For example:

Sterigenics U.S., Sotera and GTCR’s central role in this orchestrated and intentional effort has effectively placed the companies’ cash and other assets out of Plaintiffs’ reach, prevented Sterigenics from investing in emission control equipment, and dangerously de-stabilized the Sterigenics companies, thereby jeopardizing the companies’ viability and the likelihood that Plaintiffs will receive just compensation for their injuries. As Moody’s has observed, after the 2019 transactions noted above, these companies have “a high degree of environmental risk[,]” and will have “limited ability to absorb unforeseen setbacks or cash demands on the business…”

These new allegations will help juries to see what our clients have known all along: that Sterigenics and its parent companies put profits ahead of people. We are more determined than ever to get justice for our clients.

Media coverage of this story:

https://abc7chicago.com/sterigenics-paid-investors-to-avoid-paying-victims-attorney/5901024

"*" indicates required fields